5D PROFIT PROTECTOR: CAPITAL PROTECTIVE STRATEGY

PENTAGON 5D PROFIT PROTECTOR

DISSOLVING THE PROBLEM OF DRAWDOWN

WITH A CAPITAL PROTECTIVE STRATEGY

“Performance is our business”.

Jean-Marc Bloch-Lambert, CIO - The Pentagon Group

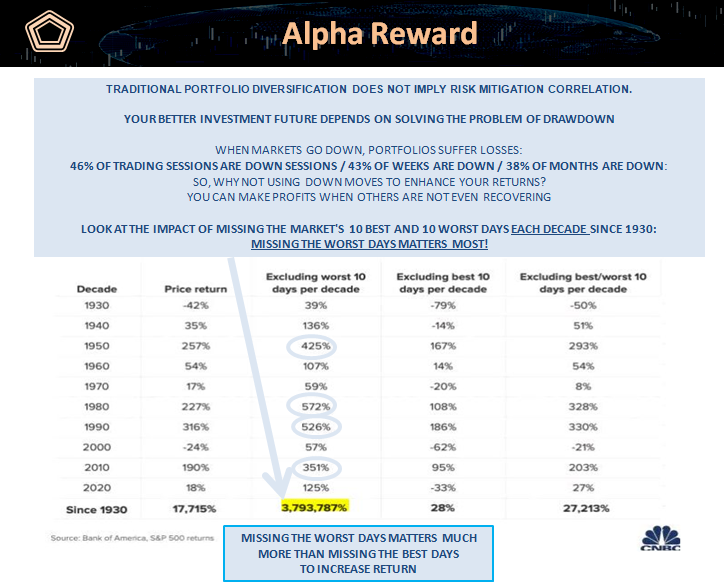

TRADITIONAL PORTFOLIO DIVESRIFICATION DOES NOT IMPLY RISK MITIGATION CORRELATION.

YOUR BETTER INVESTMENT FUTURE DEPENDS ON SOLVING THE PROBLEM OF DRAWDOWN

WHEN MARKETS GO DOWN, PORTFOLIOS SUFFER LOSSES:

46% OF TRADING SESSIONS ARE DOWN SESSIONS

43% OF WEEKS ARE DOWN

38% OF MONTHS ARE DOWN:

SO, WHY NOT USING DOWN MOVES TO ENHANCE YOUR RETURNS?

YOU CAN MAKE PROFITS WHEN OTHERS ARE NOT EVEN RECOVERING

LOOK AT THE IMPACT OF MISSING THE MARKET'S 10 BEST AND 10 WORST DAYS EACH DECADE SINCE 1930:

MISSING THE WORST DAYS MATTERS MOST!

YOU CAN BETTER CAPITALISE FROM MARKET DECLINES TO PROFIT FROM THEM.

YOU ALSO WIN ON YOUR DEFENSE, WHAT PROFIT PROTECTOR IS ALL ABOUT.

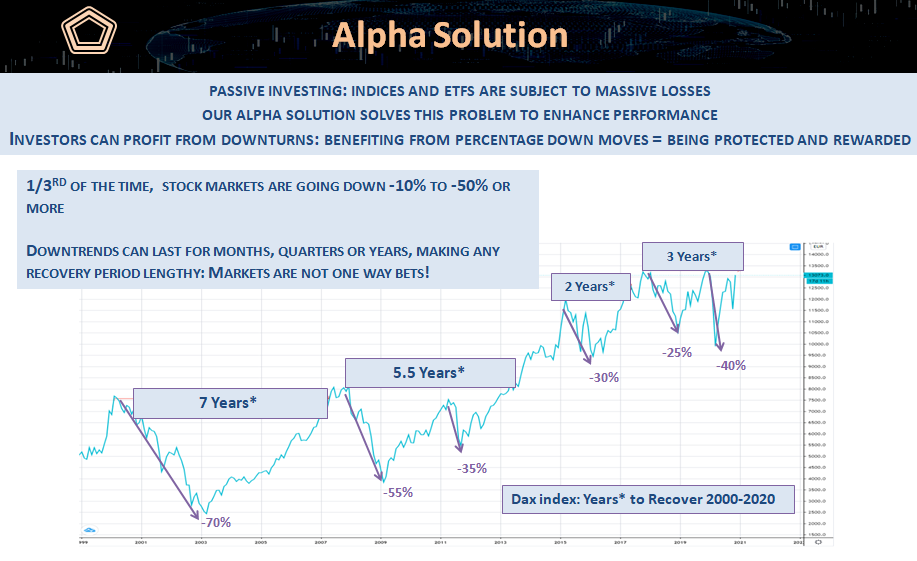

CORRECTIONS ARE ALWAYS A COSTLY REALITY: OUR SOLUTION DISSOLVES THIS PROBLEM

How to be invested in the long term trends while avoiding the intermediate declines?

That is where we offer the solution to best monetize your long term profit success.

At Pentagon, our approach is transdisciplinary: using intersecting skillsets seeking to take controlled and fixed risk.

Our overall investment process is backed by macro and quantitative analysis (cross-assets) to filter data, and to improve probability-weighted decision making.

Goal is to maximise efficiency of trade expression.

We solely use index futures (no options) allowing for accurate expression of our views for down profit capture, with pre-defined downside risk, and convex upside reward.

MAKE PROFITS DURING EQUITY MARKET DECLINES

Long-term investment success is not about finding "sure things" but about finding a slight edge here and/or there and exploiting it ruthlessly and repeatedly.

5D PROFIT PROTECTOR is designed to capture profits during market downturns.

It enables investors to gain low risk exposure while protecting from drawdown and profiting from them. Delivering Absolute Returns while offering Downside Protection by going short only, one day at a time.

5D PROFIT PROTECTOR robust principles: Active Risk-Management rule-based, Cross-Asset Flow methodology and Strict Money-Management parameters with NO overnight position.

Objectives are Capital Preservation, Downside Protection; Steady Capital Appreciation with low volatility, Negative Correlation with traditional indices; and Absolute Returns with Superior Risk-Adjusted Returns: Uncorrelated Alpha / Pure Alpha.

DIFFERENTIATED SOLUTION

5D PROFIT PROTECTOR is designed to profit

from intraday down moves in stock index futures market

Downside protection and profits when markets fall

5D PROFIT PROTECTOR stands for

5 Diversification Dimensions

1.Dynamic Hedging Alpha Solution

We cultivate our values in our integrity, consistency and superior performance, organization, operations and as principals.

Our combined experience includes managing money, advising, researching and developing actionable trading stragegies for Multi-billion-dollar funds, Family Offices and industry Legends:

advising buy-side firms such as UBS Brinson, UBS O'Connor as well as managers such as Kingdom Holding Company, Soros Fund Management, and Lombard International Assurances.

IMPROVE RISK REWARD PROFILE OF INVESTOR'S PORTFOLIO

5D PROFIT PROTECTOR is a strategy that has a negative correlation with major asset classes, indices, ETFs and even other alternative strategies.

Therefore, by adding it along your strategic allocation on Stocks /Bonds /ETFs /Credit /PERE - you can gain an edge in capital preservation: by limiting downside risk and achieving superior risk-adjusted returns.

When locating such a strategy with negative correlation and positive returns, investors can magnify this effect of uncorrelated returns as an overlay strategy.

5D PROFIT PROTECTOR is capital protective strategy focusing on excess risk-adjusted return ="pure Alpha".

PENTAGON 5D PROFIT PROTECTOR

DISSOLVING THE PROBLEM OF DRAWDOWN

WITH A CAPITAL PROTECTIVE STRATEGY

• 4 years track record history of Alpha Generation / Profit Protection

• Invested only during market declines, and stepping aside during rallies

• Disciplined methodology that avoids over-trading, over-leverage and behavioral bias pitfalls

• Reduced drawdown, profit from downside, overall smart hedging

• Improve risk/reward profile of your portfolio: increase Sharpe and Sortino Ratio by a wide margin

• High efficiency during market downturns: e.g. profit-taking phase, sharp/short correction, reversal

• Transparency, liquidity, robustness of a Managed Account structure for operations.

For additional information, if interested party - Professional / Qualified Investors only, as per MIFID directives - prospective investors can request documentation at

alpha@pentagonleaders.com

alpha@pentagonleaders.com

Past performance is not necessarily indicative of future results.

Investments involve risk of loss and may not achieve its objective.

Unified Managed Account vs. Fund or vs. AMC?

There are three main reasons why Pentagon trusts Unified Managed Accounts will be gaining market share among investment managers and investors:

i. Performance model vs. Asset gathering model: Performance-Based Asset Management provides with quality, transparency and fairness to investors, allowing portfolio manager's alignment with investors' interest: quality risk-controlled returns vs. traditional fee-based on AUM size

ii. Unified Managed Accounts allow for the manager to provide affluent investors with a high-level sophistication: similar to that which is provided to high-end institutional investors.

iii. Unified Managed Accounts allow for the manager to streamline the business: providing with the ability to better focus on managing assets and liaising more frequently with clients.

MISSING THE WORST DAYS IS EVEN MORE IMPORTANT: if an investor could make full profit during only the 10 worst days of market declines in 2020, annualized return would go from 18% to 105%

OUR VALUE PROPOSITION

TO REWARD INVESTORS WHEN MARKET FALLS

TO GAIN DURING ANY DOWN DAY

TO INCREASE ANNUALIZED RETURN

“To enhance risk management beyond naïve diversification, investors should reoptimize portfolios with a focus on downside risk, consider dynamic strategies, and depending on aversion to losses, evaluate the value of downside protection as an alternative to asset diversification.“

Our strategy and methodology are greatly derived from legendary Market Wizard Monroe Trout's strict risk-controlled approaches.

Monroe Trout – The Best Return That Low Risk Can Buy

About Monroe Trout*  https://www.quantifiedstrategies.com/monroe-trout/

https://www.quantifiedstrategies.com/monroe-trout/

LinkedIn page/ 5D Profit Protector virtual room:

https://www.linkedin.com/events/5dprofitprotectorvirtualroom-an6739262964311851008

https://www.linkedin.com/events/5dprofitprotectorvirtualroom-an6739262964311851008

The case for why investors should diversify with CTAs

https://www.ft.com/content/48f375b2-cae5-49b8-ad19-0f3ea61a28e6?shareType=nongift

https://www.ft.com/content/48f375b2-cae5-49b8-ad19-0f3ea61a28e6?shareType=nongift

Who We Serve

Our Differentiated Approach Helps Many Types of High Net Worth Investors who are:

Tired of losing when the market tanks. Told by their advisor to tolerate losses as a solution and that nothing can be done

Instructed to protect their equity portfolio by diversifying and buying defensive stocks, gold, bonds, or bitcoin

Advisors who are true Fiduciaries looking for a proven solution to stock market declines and want to help their clients:

Protect their stock market gains - or any portfolio of assets - with less downside volatility, Profit from market downturn

Some traditional Stocks/Bonds/Real Estate Investors and Funds looking for an industry leading expertise with a track record of outperforming its peers:

Generating short side alpha Profiting from stock market weakness, Beating their benchmark in down markets

Foundations that have buy and hold exposure, and are looking for liquid equity risk mitigating investment strategies.